JOHN MCLAREN-STEWART

CEO, VENTURE RISKS GROUP

THINKING ABOUT CUTTING YOUR INSURANCE COSTS? BE WARY.

WEDNESDAY 20 MAY

It’s a tough world out there at the moment. In these difficult times we know it is very tempting to try and cut costs or reduce insurance cover levels. If there is little or no income coming in the axe has to be wielded. Please be very careful about this.

The hysteria surrounding Covid seems not to be abating but there is a further worrying trend recently picked up by law firm Kennedys – the rise of newly incorporated ‘claims farming’ companies.

Data monitored by Kennedys noted that over 45 companies had been set up in recent weeks containing the name ‘corona’ or covid. Many of those include words such as ‘compensation’, ‘claims’ and ‘refunds’ suggesting that these companies are being established to encourage people to sue companies for alleged business mismanagement, employee injury and distress, third party injury and others.

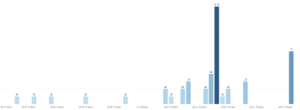

The diagram below from Companies House gives an indication in the surge in companies established:

A quick search across Google also highlights that many law firms have already set up divisions or hotlines to deal with potential claims against companies.

It is not hard to see there will be a whole new trend building here as people seek compensation across Employers Liability, Public Liability and Management Liability insurance policies (amongst others) against companies.

In the US there are already a spate of Management Liability actions against company directors for covid-19 related incidents.

Insurance is used to protect your business and your own personal assets. It transfers a risk liability that can be financially (and possibly fatally) damaging, onto the balance sheet of your insurers in return for a (relatively) small premium payment. Insurers give you access to funds, legal expertise and many years experience in dealing with claims.

In the event that you or your company is sued, using a defence of ‘it’s not our fault’ or ‘we haven’t been negligent’ even if they are true cuts no ice with lawyers and courts. You need to be able to defend yourself and that involves legal support, which is never cheap. Your insurance policies pay for you to defend yourself against both genuine and spurious claims.

Some examples of how a business and or its directors may be sued across EL/PL/Management Liability insurance:

- Poor communication and control in an emergency/health situation

- Lack of provision of adequate PPE equipment

- Failure to have a business continuity plan to avoid disruption to business

- Failure to protect third parties in dealing with your company/employees

- Unfair dismissal/wrongful termination of employee contracts

- Employee distress caused by lack of proactive management of the crisis within the business.

- Bodily injury if an employee becomes infected with COVID-19.

- Bodily injury if a customer becomes infected with COVID-19.

- Discrimination if the company is managing risks differently in different locations, teams, gender etc

- Financial loss of employees

- Financial loss of shareholders/investors

- Regulatory action for failure to maintain adequate systems and controls

Take care if looking to reduce your insurance costs and/or levels of cover. There is a growing level of activity amongst claims farming and legal firms looking to cash in on the current economic situation. Claims action will start slow, then pick up as business return to work.

In these difficult times, there are also increasing exposures across Cyber, Professional Indemnity and Trade Credit insurance. We will discuss these in our next blog.

If you would like to share an article or any advice to be included, please send it to [email protected]